On April 16, 2020, Fuel (our sister agency that specializes in guest-facing software and marketing for hotels) fielded the second round of its COVID-19 Consumer Sentiment Study. This research follows Fuel

’s first study fielded on April 2, 2020, and is specifically designed to shed light on the pandemic’s impacts on leisure-travel consumers, how it has impacted their current travel plans, what will motivate them to take a leisure vacation once restrictions are eased, and the timing of when they plan to travel again. The full results of the latest study can be downloaded here.

Over 10,300 travelers responded to this survey, which was administered among members of Fuel’s in-house consumer panel of over 500,000 consumers who take at least one leisure vacation a year. After conducting the first study roughly two weeks ago, several new questions were added, including queries related to demographics, number of vacations taken per year, type of vacation usually taken and the timing envisioned for future travel.

Respondent Demographics

The survey respondents are frequent leisure travelers, with 75% taking two or more vacations per year. 69% of the respondents were female and 31% were male, with the largest age group represented being 56-74 (51%), and the next-largest group being 40-55 (35%). 39% of the respondents have children living at home, which is consistent with the age spectrum. The geographic breakdown of the respondents is detailed in the full report, however the top states represented in order of total number of respondents were:

- North Carolina

- Pennsylvania

- South Carolina

- Ohio

- Virginia

- New York

- West Virginia

- Tennessee

- Georgia

- New Jersey

COVID-19’s Impacts on Travel Cancellations & Rescheduling

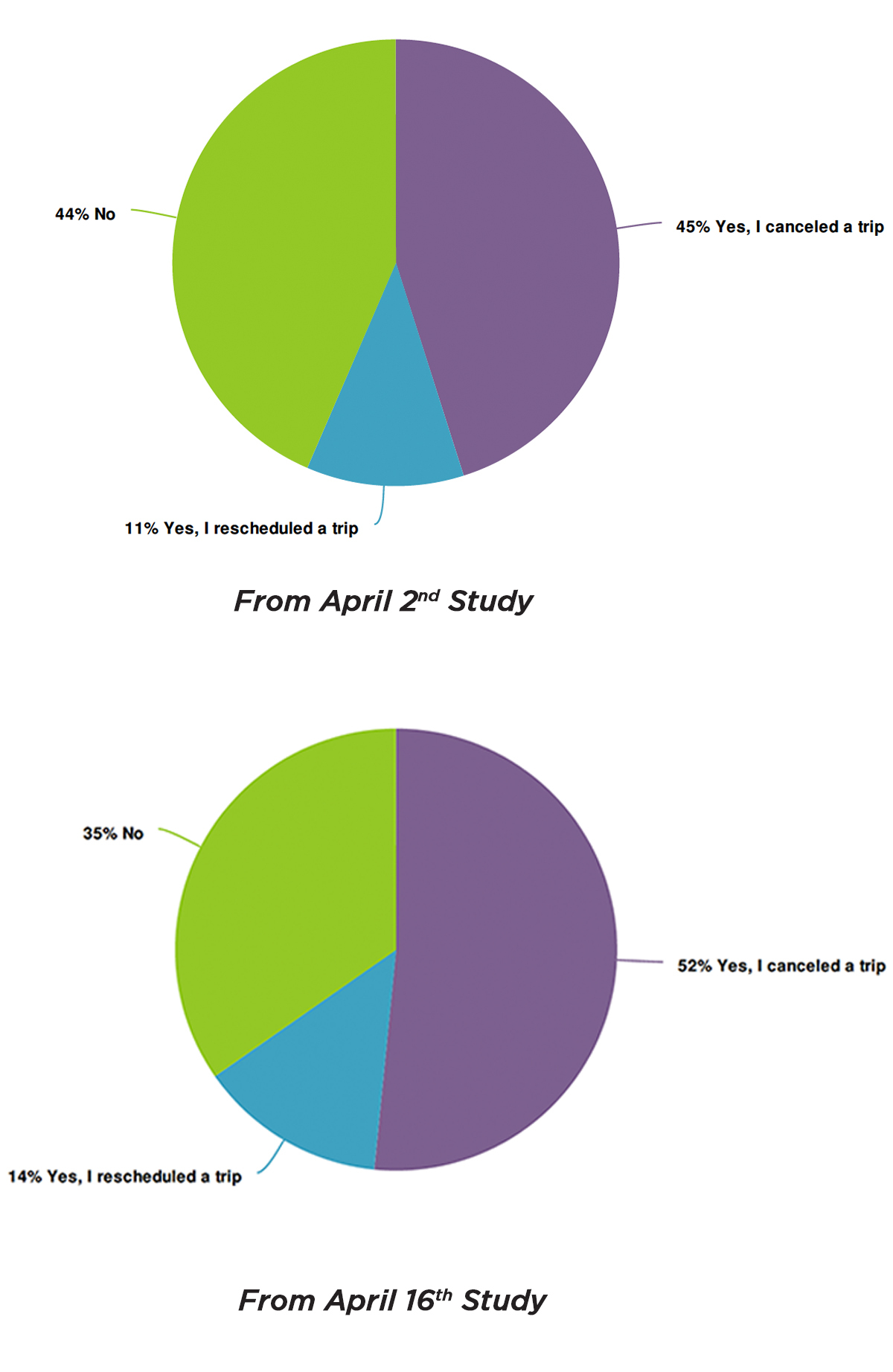

The results of the studies highlighted some interesting changes over the two weeks between their administration. The incidence of those having a trip affected by the coronavirus outbreak increased. In the first study, 45% of the respondents had canceled a trip and 11% had rescheduled, with 44% saying the outbreak had not impacted any of their trip plans. In the second survey, 52% had cancelled a trip and 14% had rescheduled. These results follow two weeks of increasingly bad news in terms of infection rates and deaths as a result of the virus, along with the announcement of beach closings in many popular destinations in Florida and all along the East Coast.

COVID-19’s Impacts on Planned Length of Stay

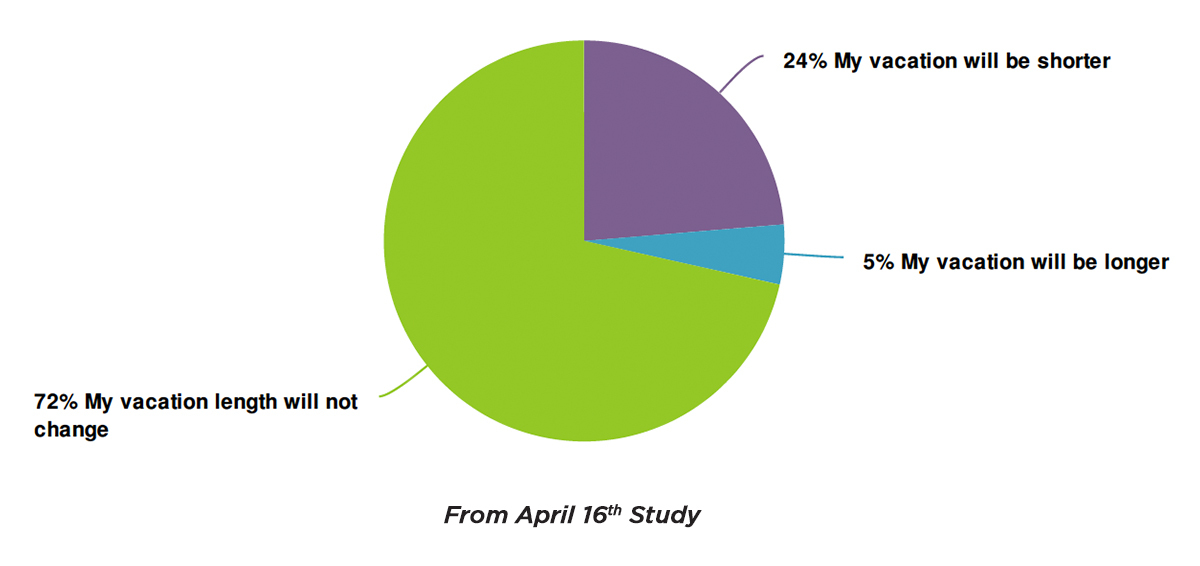

In the second study, we added a question aimed at gauging the pandemic’s impacts on planned length of stay. The good news is that 72% of respondents indicated that their length of stay would stay the same, while 5% indicated that their stay would actually be longer than previously planned. 24% indicated that their next vacation would likely be shorter.

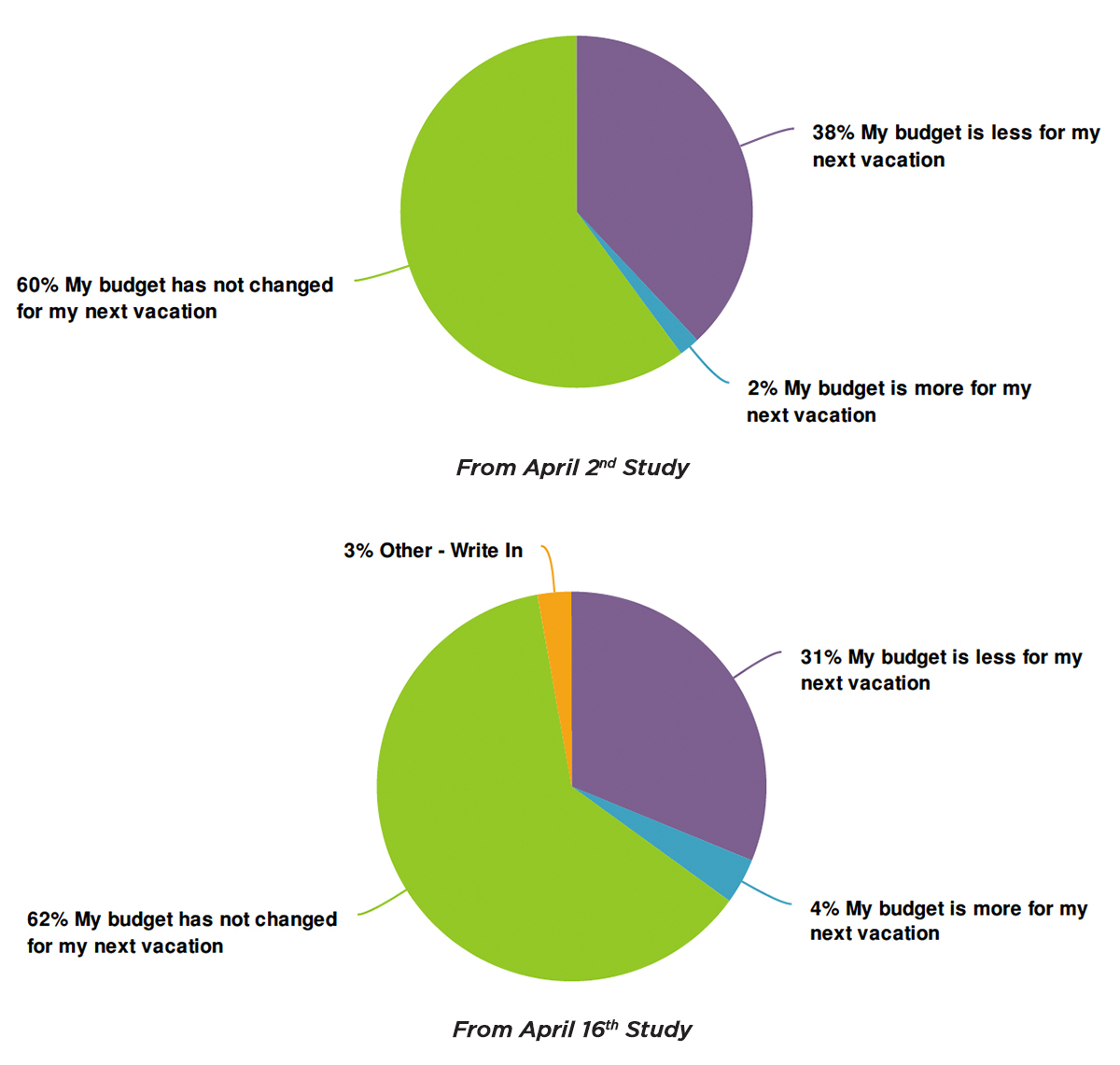

COVID-19’s Impacts on Vacation Budgets

When respondents were asked how much they intend to budget for their next vacation, the study fielded on April 2, 2020, indicated that 38% planned to budget less for their next vacation. In the most recent survey, this number had decreased to 31%. These results could be impacted by several factors, including the receipt of stimulus checks from the U.S. government, along with an increase in certainty and job security as the economy begins to open up.

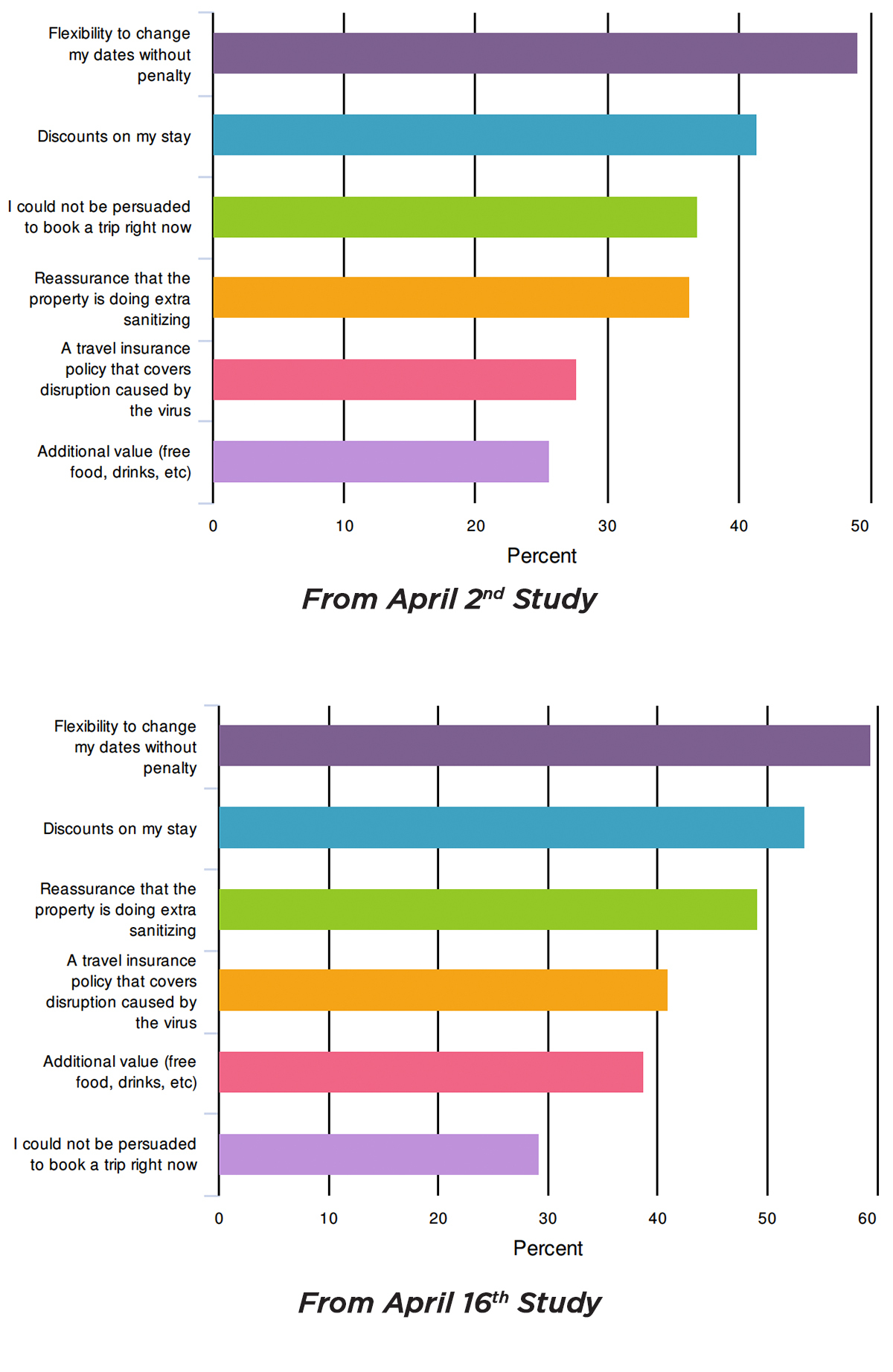

Consumers Prefer Flexibility for Immediate Bookings

When asked what would persuade them to book a future vacation now (during the outbreak), these consumers made it very clear that they would be motivated by offerings allowing the flexibility to change their travel dates without paying a penalty. In the first survey, 48% of respondents indicated that they would be persuaded by such offerings. In the most recent study, this number jumped to 58%! This is a clear indication that there is much uncertainty in consumers’ minds regarding when stay-in-place orders and beach closures will be lifted.

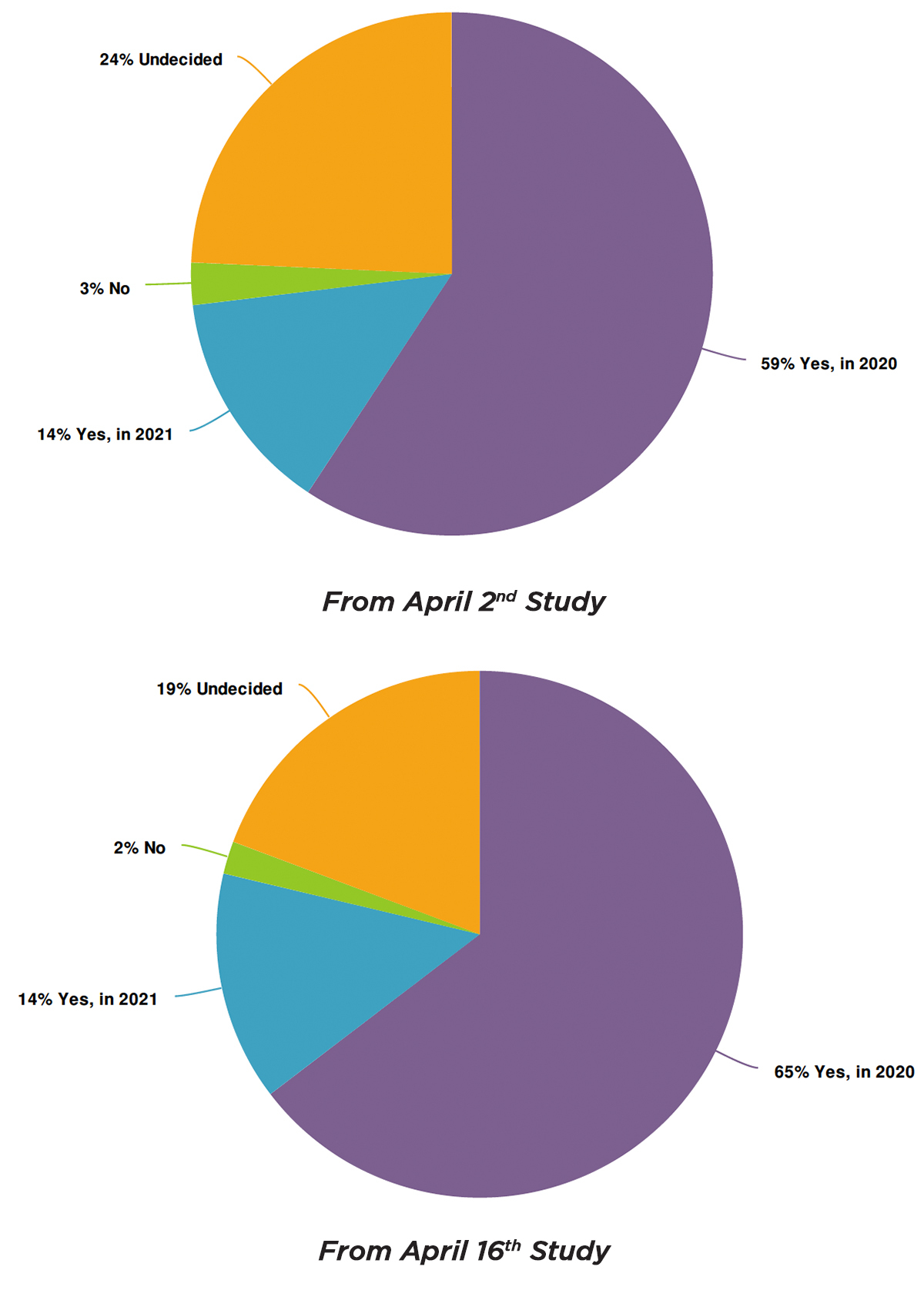

COVID-19’s Impacts on Consumer Travel Intentions

The lockdown orders have also had an interesting effect on the numbers of consumers feeling the “need” to take a vacation. In the first study, 59% of respondents indicated that they still intended to take a vacation in 2020, with 24% still undecided. In the latest study, 65% said they intended to take a vacation in 2020, with 19% undecided. This is a significant jump in the percentage of consumers who intend to travel in 2020. The lockdowns coupled with being cooped up inside for significant periods of time is stirring the desire to vacation.

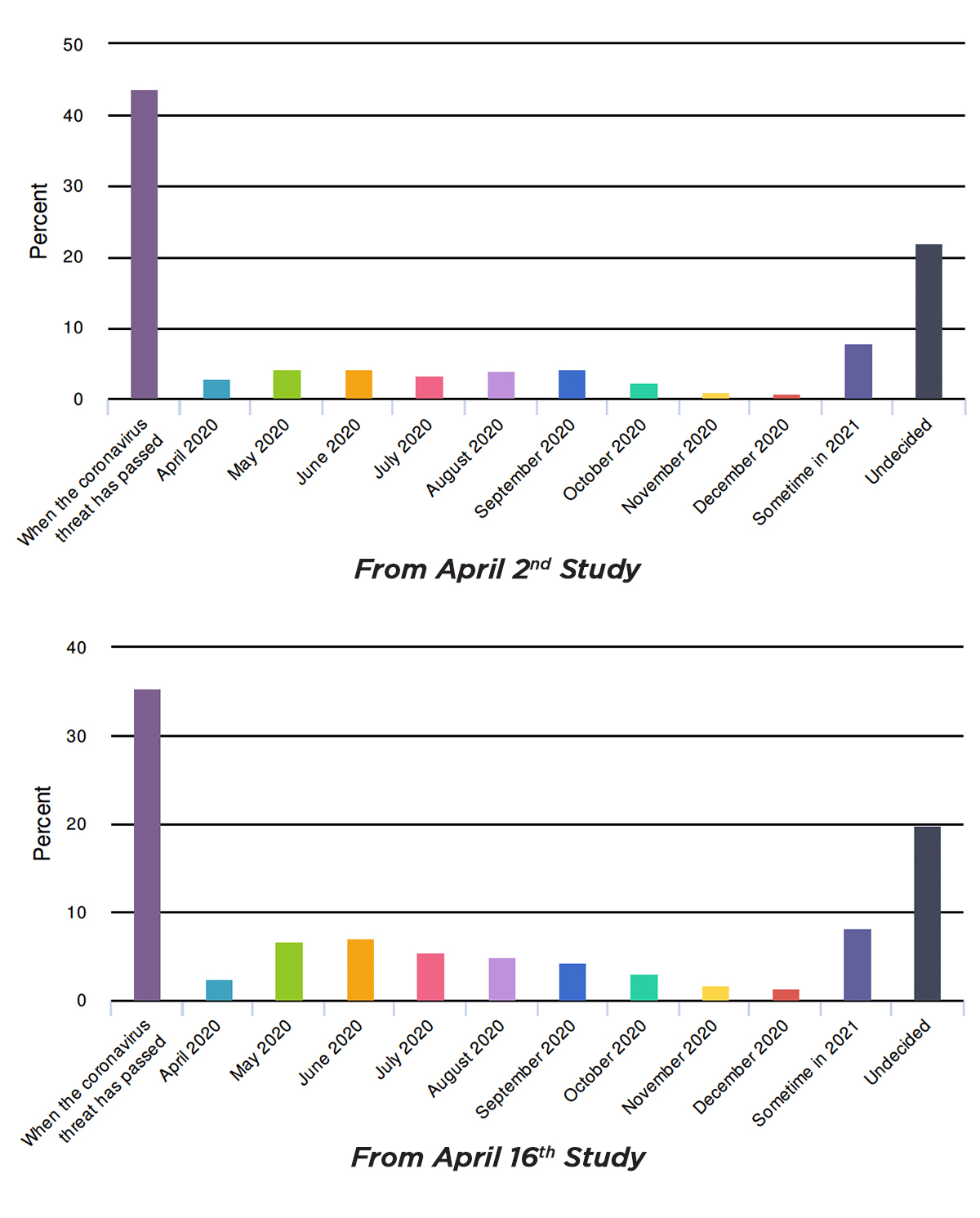

Building on what we learned in the first study, we wanted to lean further into the timing of the decision-making and the actual booking of respondents’ next trip. The results are very interesting and can help guide hoteliers in their messaging. When asked how likely they would be to book a trip in the next 30 days, it was clear that the majority of respondents felt it was too soon, with over 62% saying definitely not or unlikely. That said, over 15% of respondents indicated that they would be likely or very likely to book a trip. So, there is a segment of the market out there that is willing to book a trip in the next 30 days. But, when we extended the time period to 60 days, the results changed dramatically, with 28.4% saying they were likely or very likely to book, and the definitely not or unlikely group dropping to 40%.

When asked when they intend to BOOK a future vacation, over 43% in the first survey indicated that they would book when the coronavirus threat had passed. In the most recent survey, that number decreased significantly to 35%. This could be an indication that consumers realize that the threat will not pass completely until a vaccine or new effective treatment is found, or that the psychological need to take a vacation is growing while their movement is restricted due to local stay-at-home orders.

Key Takeaway: Prioritize Safety & Positivity

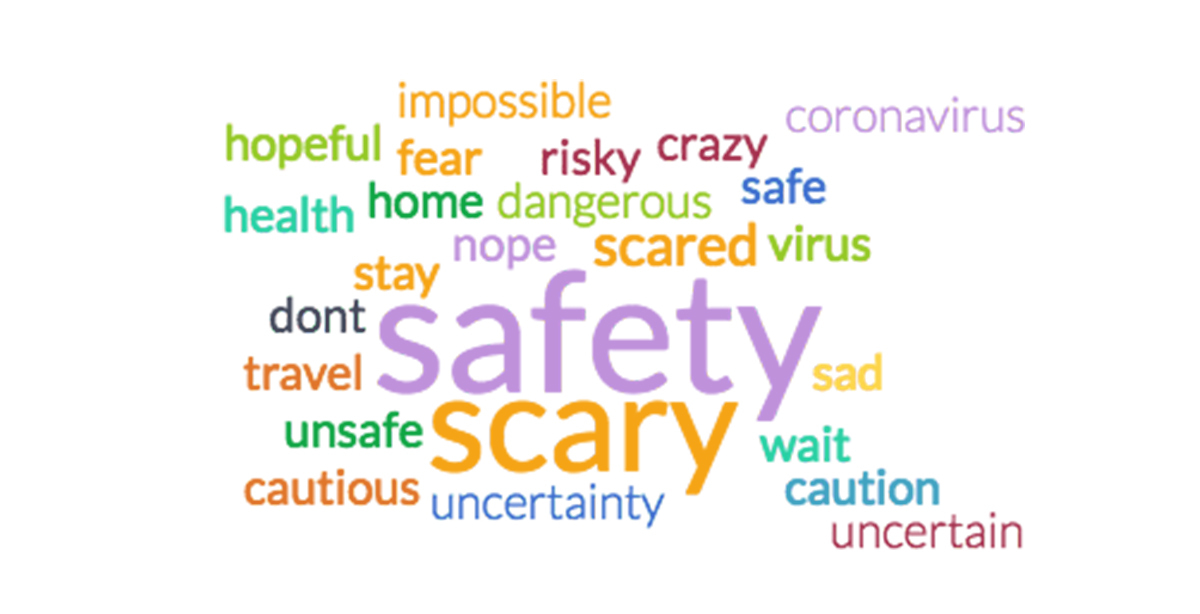

Perhaps the most significant insights to be gained from the study relate to how consumers “feel” about travel right now. When asked, “What is the first word that comes to mind when considering travel right now?” — by far the number one response was “Safety,” followed by “Scary.” With that in mind, hoteliers must immediately begin the process of developing new cleaning standards and protocols. Then they must develop messaging centered around these new standards to help address guest fears.

The full results of each study can be downloaded here. In order to help our clients and the travel industry as a whole, we will continue to re-field the study every two weeks to compare results and monitor consumer intent.

Scott Brandon

Chief Executive Officer

Scott has led the growth of Brandon into a Southeastern powerhouse with over 120 employees in four offices across the U.S. As a highly sought-after strategist and business-minded visionary, he has helped develop and grow brands such as YETI Coolers, Southern Tide, CresCom Bank, Williams Knife Co. and Fish Hippie. Always on the forefront of technology, Scott’s focus is on data-driven marketing and developing growth minded strategies and tactics. Although he has an endless passion for marketing, Scott is happiest when he is outdoors hunting and fishing with his family.

By subscribing to our newsletter, you agree to our Privacy Policy.