It’s been a long time coming.

When in human history has humanity shared this much in common? From sprawling metropolises to country outposts, in nations around the globe, governments implemented directives to slow the spread of COVID-19, beginning in March. In many parts of the world, restrictions on movement are loosening. Consumers itching to leave home and travel are making plans. The question is: How will we know when it’s safe to travel?

Global Web Index, a market research SaaS company that provides audience insight to publishers, recently examined what’s next for the travel industry on the coronavirus timeline. GWI sought to determine who the public will trust for guidance on a new normal of post-virus behaviors in polling that spanned the globe.

Alison Tedford is a content marketer in Abbotsford, British Columbia, population 149,000. This community along the Canada-U.S. border, like many American cities, has begun its next phase of re-opening: Restaurants open, at reduced capacity and personal protection equipment; and schools open, with a reduced schedule.

Locally, Alison says, she’s still nervous.

“We are still being asked to social distance and largely I’m still staying home,” she says. “I get my daily coffee but otherwise, we work and school from home and are content to wait out the ongoing risk. We have a strong public health officer (Dr. Bonnie Henry) in our province who is very encouraging and supportive.”

Many people are similarly wary.

Globally, 31% of consumers say they’ll trust their government’s recommendations on when it’s safe enough to travel. Nations with a low-end 20% trust rate in governmental guidelines include Brazil, France, Italy, Japan, Spain, and the United States.

Optimism is more widespread (40%) in other countries, such as Australia, India, Singapore, and the United Kingdom.

What can boost our confidence to take that trip?

Wannabe travelers most commonly trust one source as their ready-to-travel-ometer: Themselves. 58% said they’ll move when they feel safe. 31% say the government’s lifting of lockdown conditions would do the trick, the same percentage as said they’d put their stock into governmental advice. Countries reopening borders and feeling secure in one’s finances and the job came in at 28%.

Laura Messner is an entrepreneur in Nashua, a town of nearly 900,000 in the southern part of New Hampshire. Reopening is happening there for restaurants and salons, and she says she’s ready to travel when restrictions are lifted.

“I will travel when they say it’s okay because, at that point, people will be extra cautious, so it’ll be extra safe,” Laura says.

Frequent travelers in Australia, China, New Zealand, and Singapore are more likely to trust that reopening borders signals safe travel. Other countries, hard-hit in the early stages of COVID-19, are likely leerier of a second outbreak – or perhaps deeper trust issues with their governments.

Younger travelers are more likely to tie their travel prospects to a sense of well-being financially, and with their employment. An audience more advanced in their careers and approaching retirement, aged 55-64, are less likely (18%) to worry about finances when it comes to travel.

Generations are divided on who to trust for travel advice, too.

Only 25% of those aged 16-24 frequent travelers would plan travel just because borders reopen. Their 55-64 counterparts, the ones who feel more financially secure? They’ll trust their own judgment (two-thirds) over anything else.

It turns out our past experiences shape our sense of trust and tolerance for risk. Resonate is a technology company that combines big data and psychographic survey studies to understand consumer attitudes, beliefs, and values. In ongoing research, it revealed significant divides on how far people are willing to travel. When asked where they’d feel comfortable traveling when restrictions are lifted, this is what they found:

58.3% of respondents would travel within their state

36.7% of respondents would travel to other states

10.8% of respondents would travel internationally

Alison says she’ll listen to British Columbia’s public health officer’s advice: Enjoy where you live.

“I don’t think I will be traveling anytime soon,” she says. “Traveling to a city that has fewer health resources during a pandemic puts their community at risk and I live somewhere with a really great hospital and I wouldn’t want to be far away from it.”

What about a staycation?

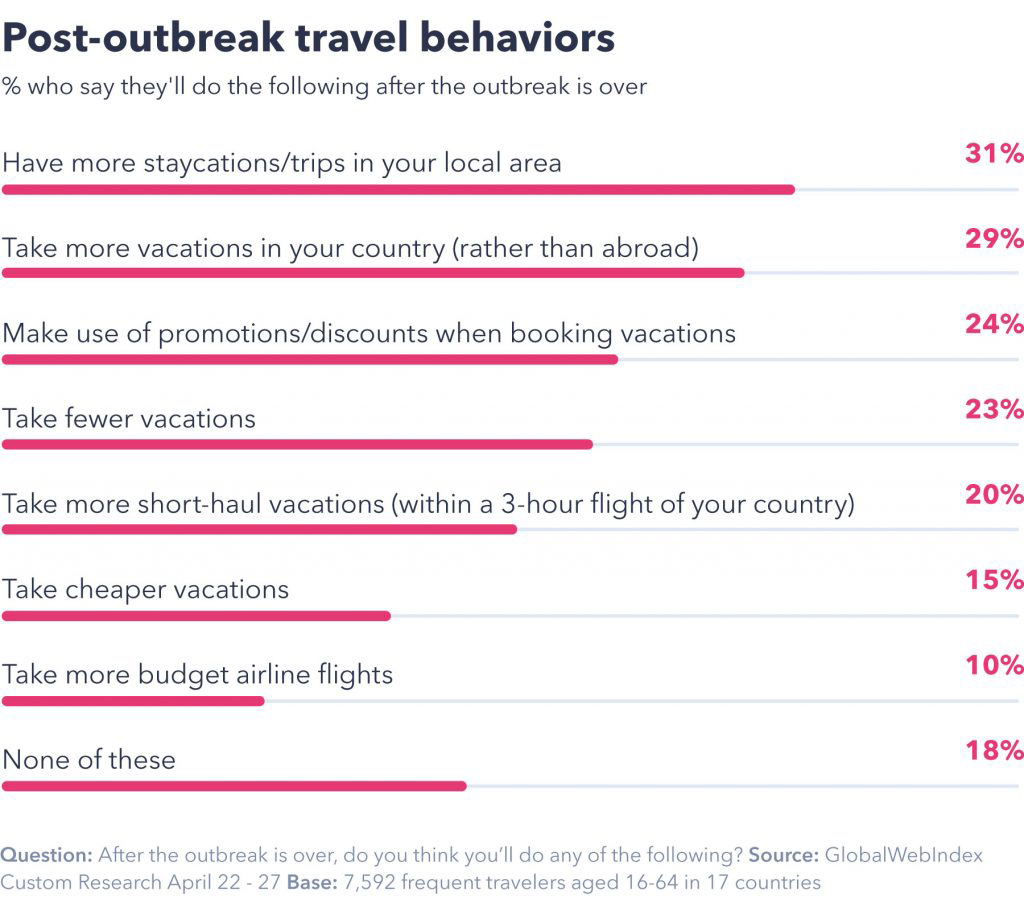

The domestic vacation after the outbreak seems a good transition for the frustrated traveler. Among frequent travelers surveyed, 18% said they’re more likely to stay close to home.

GWI data shows frequent travelers in Asia Pacific (38%) and Europe (32%) will cut their travel distance. Resonate research delved into what it would take to get Americans to cross state or international borders. The most important factor in visiting other states to those travelers: A widely available coronavirus vaccine. To travel internationally, that figure rises to 45%.

Source: GlobalWebIndex

People who’ve traveled more before the outbreak are more likely to resume travel sooner. In Latin America, consumers said they wanted discounts and promotions (44%) when booking vacations. As economies emerge from financial hardship and employment uncertainty, the cost will become a huge consideration for travelers. How brands advertise and promote deals – and how they’ve dealt with the pandemic in a humanitarian crisis – are also key factors.

What should brands do to appeal to their audiences after COVID-19?

Just mustering advertising dollars is a challenge. But frequent travelers supported brands running business-as-usual ads during the outbreak (55%), chief among them, the 25-34 set.

Not surprisingly, brands that have already pushed offers and flexible payment options and cancelling policies (more than 84%) found the most favor with consumers. Other brand activity that landed well:

87% | Providing practical information to help people cope with the pandemic

82% | Ads that show a brand’s response to COVID-19 or helping others

80% | Letting consumers know how they’re responding to coronavirus

Flexible payment terms appeal to 16-24-year-olds most (85%), indicating a yearning to move, but skepticism about their bank books and jobs. Frequent travelers of all ages approved of advertising of brands pledging aid to people affected by the outbreak.

During times of their own fiscal unrest, companies who put service outside their business first or suspended normal operations to produce supplies for essential workers saw huge support. This emphasis might become part of the criteria consumers consider for gaining their business.

For travel, long-term changes are yet to be seen. The industry saw radical changes in security after the 9/11 attacks – some that remain as part of travel’s fabric today. And the reinvention of the new-normal will continue.

“We could see more local people being tourists in their own town and taking advantage of the tourist attractions that are local to them,” Alison says. “Maybe this is the year of the staycation.”

Source: GlobalWebIndex

By subscribing to our newsletter, you agree to our Privacy Policy.