Since the COVID-19 lockdown began in March, businesses and consumers have anxiously anticipated the reopening of commerce. The reality, as restrictions are lifted? Less of a stir and more of a timid response.

To many, that journey to the department store or favorite cafe is the first non-essential shopping experience in months. Has the power – and necessity – of online shopping altered the path to purchase, permanently? And how have brands both successfully steered through the lockdown months, while still remaining flexible enough for the eventual in-store shopping – and whatever hybrid will come next?

GlobalWebIndex is a market research SaaS company that provides audience insight to publishers, media agencies, and marketers globally. It surveyed people about coronavirus’ effects on how we shop, and how consumer posture has changed as a result of it.

Restrictions swept across the world that made brick-and-mortar shopping difficult, if not impossible. And retailers had to adjust – with little or no time for strategy.

Ready to go back in?

Our shopping appetite hasn’t waned – it’s shifted. Now that limitations have changed for some, the itch to shop ‘til we drop, old-school style, is returning. For some, there are more long-lasting changes to spending.

GWI’s Wave 4 of coronavirus studies reveals more than half of internet users said in May they’d start shopping immediately, very quickly, or quite quickly. In Wave 3, in March, it was 4 in 10.

Millennials, age 24-37, surged to the lead with 55% ready to shop, in Wave 4. In Wave 3, Gen Z, aged 16-23, led the way (46%). Gen X (38-56) at 47% and Baby Boomers (57-64) ranked third and fourth, both rising (9% for Gen X, 8% for Baby Boomers).

Safety is a concern for all: 68% want regular cleaning of public spaces; for 58%, social distancing measures are most critical. Other crucial factors include providing hand sanitizer (57%) and mask mandates (53%). Baby Boomers put the most onus on brands to spur a return to normalcy in retail (79%). Figures descend with age, including 73% of Gen Z shoppers.

Older consumers didn’t shop online (70%) as frequently as global internet users (74%). They’re most likely to isolate with caution. So open doors are probably a welcome return to life as usual.

Nations recovering or less severely affected by COVID-19 are most eager to shop again, led by Poland (72%) and Australia (66%). Hard-hit counties – Italy (38%) and Brazil (35%) – aren’t. As shoppers hit the streets, online purchases are unlikely to drop: 46% of internet users said they’ll cybershop more, even post-outbreak.

“Organically, I feel like we’ve seen increases in both people visiting the site and revenue for most of our e-commerce clients since March and April,” said Sabrina Beaver, SEO specialist at The Brandon Agency. “However, that appears to be decreasing/evening out with 2019 now.”

Cyber shops prove convenient and better-stocked in most cases than their physical locations. That won’t likely change as the virus passes. Online shopping is continuing its steady climb, at 74% of consumers partaking at least partially in cyber commerce since 2017.

“At The Brandon Agency, many of our clients that have typically worked the B2B (business to business) channel have shifted their focus on DTC (direct to consumer) – said TBA e-commerce specialist Mo Grissom.

“Some clients are having record-breaking sales on their own e-commerce platform,” Grissom said. “There is also a big push for marketplaces sales such as Amazon and Etsy, which is a great way to open your e-commerce business up to more consumers. They say Amazon now claims around 49% of all e-commerce sales.”

A CNBC report confirms that percentage, way ahead of competitors eBay, Apple, and Walmart.

How to entice consumers back in-store

Experts expect the world economy to shrink more than 3% in 2020 – surprising, given the increased shopping forecasted after the outbreak. Markets outside the U.S. and Europe won’t absorb as much of the economic damage immediately post-COVID.

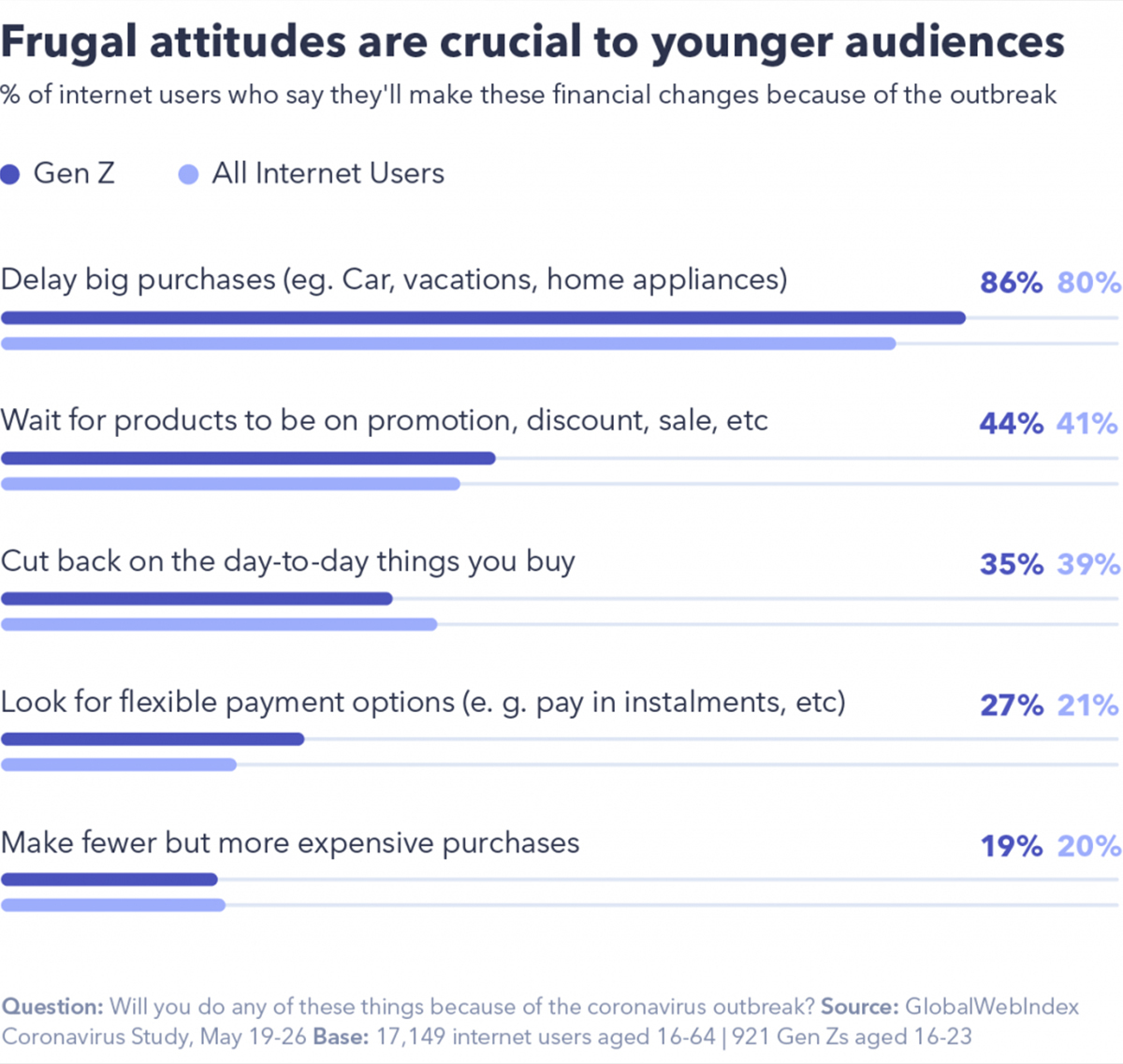

Whose commerce world will thrive? In 17 markets, 30% of internet users said they’ll follow the best deals, regardless of brand. Most agree they’ll delay big purchases, 80%, in the 20 markets surveyed. In most segments, Gen X buyers show more frugality than the average shopper.

Some thrifty habits had begun before coronavirus.

Years of cost-centric trends preceded COVID-19. As 41% of internet users express patience for discounts and promotions, that mindset existed with the lowkey panic of an impending recession. Coronavirus’ impact boosted those fears. To reach reactionary consumers, brands combine discounts and promotions with additional services, such as collecting in-store. This appeals to concerns about saving money but motivates consumers to use features they might have avoided before. Brands that offer flexible payment terms have the highest approval rating (88%) among Gen Z and Millennial shoppers.

Online and offline: A perfect match?

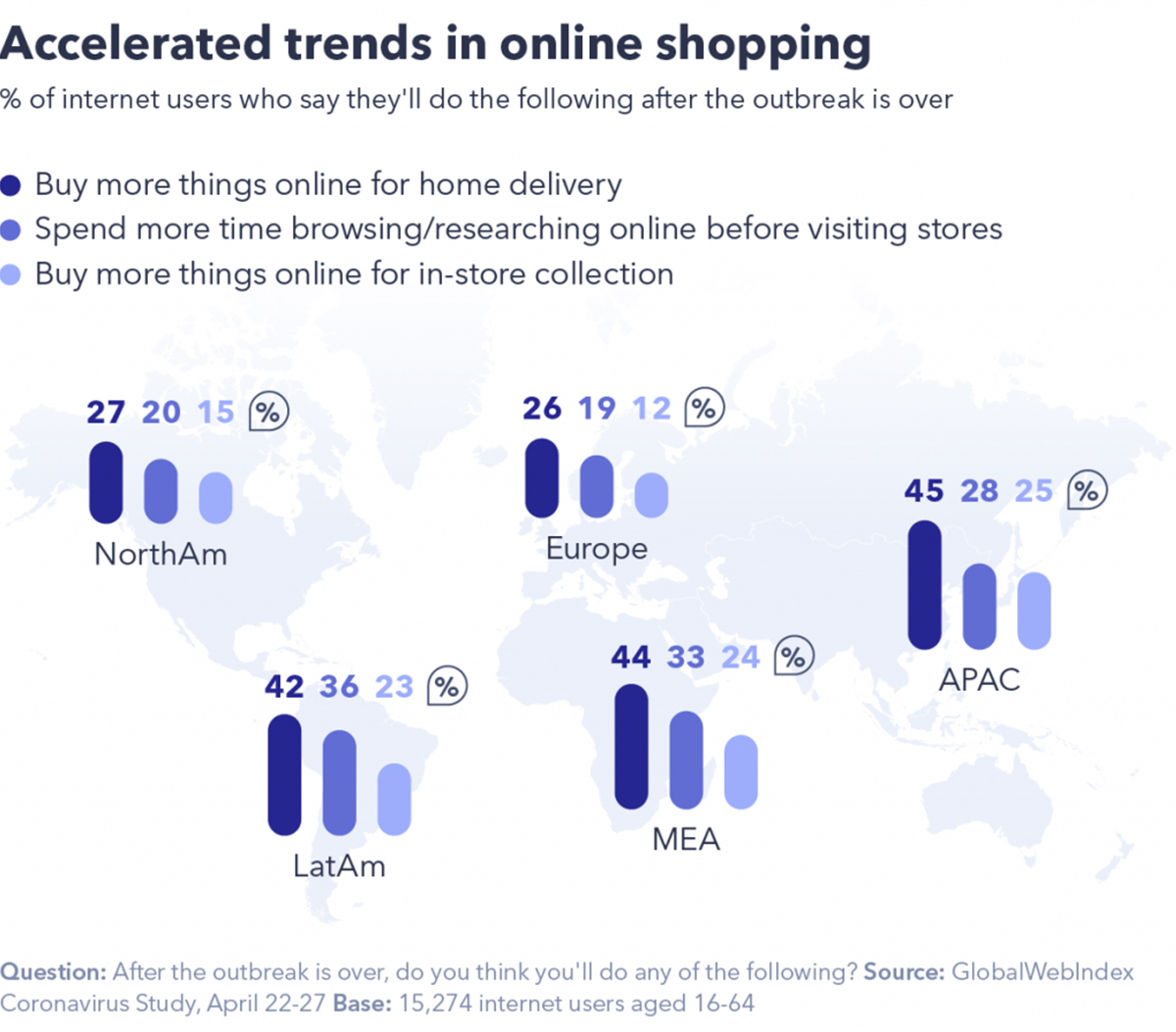

Shoppers’ propensity for online shopping won’t mean retailers need to overhaul strategy post-COVID. Globally, 22% of internet users want to buy in-store when able – with Millennials (26%) leading the way – compared to 15% who want to keep clicking and picking up.

Retailers are banking on those shoppers buying more when they stop by to pick up.

The Middle East and Africa led the way for years in click-and-collect: 22% there say this would improve the chances of making a purchase. That’s 50% more than the global average.

In Wave 3 of COVID-19 studies, Asia Pacific (25%), Latin America (23%), and North America (15%) saw in-store collection on the rise. For North America, that was twice as likely as before the outbreak (7%). Consumers are increasingly researching online before they visit stores, a key factor in recovery spending. More than 25% of internet users said they’ll continue that trend. Online ads will lead the way for retailers more so than out-of-home advertising as a result.

Social media led to product discovery for 1 in 4 internet users, demonstrating a fertile ground for touchpoints and updates, especially in the journey to the cart: almost 4 in 10 consumers research purchases on social media.

What’s next?

The forecast: A boost in brick-and-mortar shopping, without a corresponding drop in online commerce. Shopping after the pandemic likely won’t be so hands-on, trying on makeup or testing out toys in the aisles, according to the Washington Post. “The focus now is on making shopping faster, easier, and safer to accommodate long-term shifts in consumer expectations and habits,” the newspaper said.

Nick McNeill is the Interactive Director at The Brandon Agency. He says most of the agency’s clients have seen a huge boost in Q2, but that has leveled off during the summer.

The Brandon Agency’s clients were out ahead of the coronavirus-induced shopping shift, back in March. Mark Harrison is an optimization & analytics specialist at The Brandon Agency. He said the agency recognized in March that online shopping would be hopping. They made a slight adjustment in organic search – to excellent results.

“We added ‘buy/shop online’ related messaging to our meta titles and descriptions,” Harrison said. For three Brandon Agency Clients – FIREDISC, Fish Hippie, and frogg toggs – effects were similar, and all positive.

“There were increases in revenue in Q2, particularly in April and May,” Harrison said. “In Q3, we are still seeing year-over-year increases, but at a more expected rate month over month.”

Those brands – FIREDISC, a line of portable propane cookers; Fish Hippie, a men’s lifestyle apparel line; and frogg toggs, makers of rain gear – saw longer-term gains, March through July, in conversion rate, an measure of the percentage of visitors to a site who navigate there with an intention. “It indicates more users are ready to make a purchase when navigating to the site,” Harrison said.

“One distinct trend I am seeing is the drop in revenue per user in March and then its increase in April,” said Maria Peters, digital analytics specialist at The Brandon Agency. “I’m speculating here but I think there was a lot more uncertainty in March when it came to the economy and the job market. Since then, the user has been mainly increasing with a slight drop in July.”

In July, restrictions in many U.S. cities lifted to varying degrees, allowing for shoppers to get out of their homes a bit and shop on a limited basis. Brands such as those the Brandon Agency helped weathered a period full of doubt for the marketplace and prepare for the next stages in the retail industry.

The road to increased foot traffic in-store runs through the internet. It’s laced with incentives and features to replicate an in-store experience online – and can usher in a period of slow recovery to a new normal, whatever form that takes.

For The Brandon Agency clients, e-commerce has been part of the plan for a while.

“Prior to COVID-19 e-commerce was on the rise and it seems that trend will continue,” Grissom said. “Brick-and-mortar stores will exist, but you see more and more companies put most of their focus on their e-commerce sales. This upcoming holiday season is going to be more e-commerce driven than ever. With many big box stores closing down for Black Friday it is turning the attention to websites and marketplaces.”

Sources: CNBC, GlobalWebIndex

By subscribing to our newsletter, you agree to our Privacy Policy.