On March 17, 2020, our research partner – GlobalWebIndex – released a study looking to better understand the impacts COVID-19 on the travel consumer as well as the industry as a whole. As we continue through this unchartered territory, we will continue to monitor the situation and keep you as up-to-date as possible on what we learn so you can continue to forecast and plan with solid data.

You can find this study below:

No industry will be left untouched by coronavirus. And no industry is likely to be more affected than travel.

Usually the first to feel the impacts of any global crisis, airlines around the world have issued urgent calls for government intervention.

Faced with exceptional circumstances, the travel and tourism industry has found itself grappling with an unprecedented level of disruption, as more borders close and travel restrictions mount.

It’s impossible to anticipate how the rest of this year will pan out. But we can provide some insight into how vacationers are thinking about the crisis, the more long-term impact COVID-19 will have on travelers, and what sort of tactics will be needed to reinvigorate the market.

You can find full reports and updates on the consumer response to COVID-19 in our hub.

Uncertainty and restrictions around travel plans are growing.

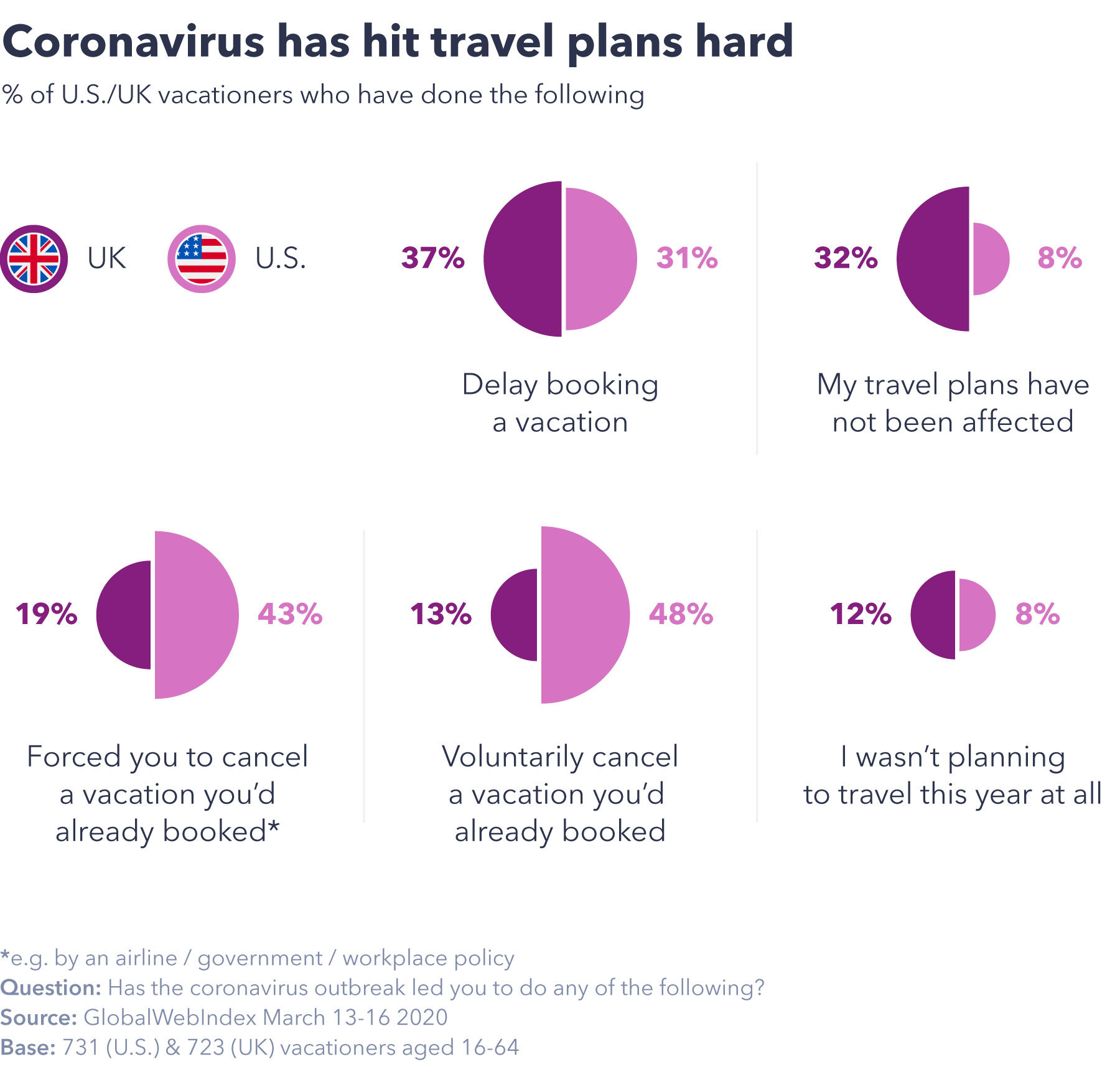

Analyzing consumers’ current travel plans gives some sense of the gravity of the situation.

In the UK, only 32% of vacationers (defined as those who usually take at least one vacation a year) haven’t had their travel plans affected by coronavirus.

In the U.S., this drops to just 8%. Almost half of U.S. vacationers have canceled plans because they were forced to, and even more have done so of their own volition.

There’s no hiding from the fact that this year, vacationing throughout the summer will be off the cards for many people.

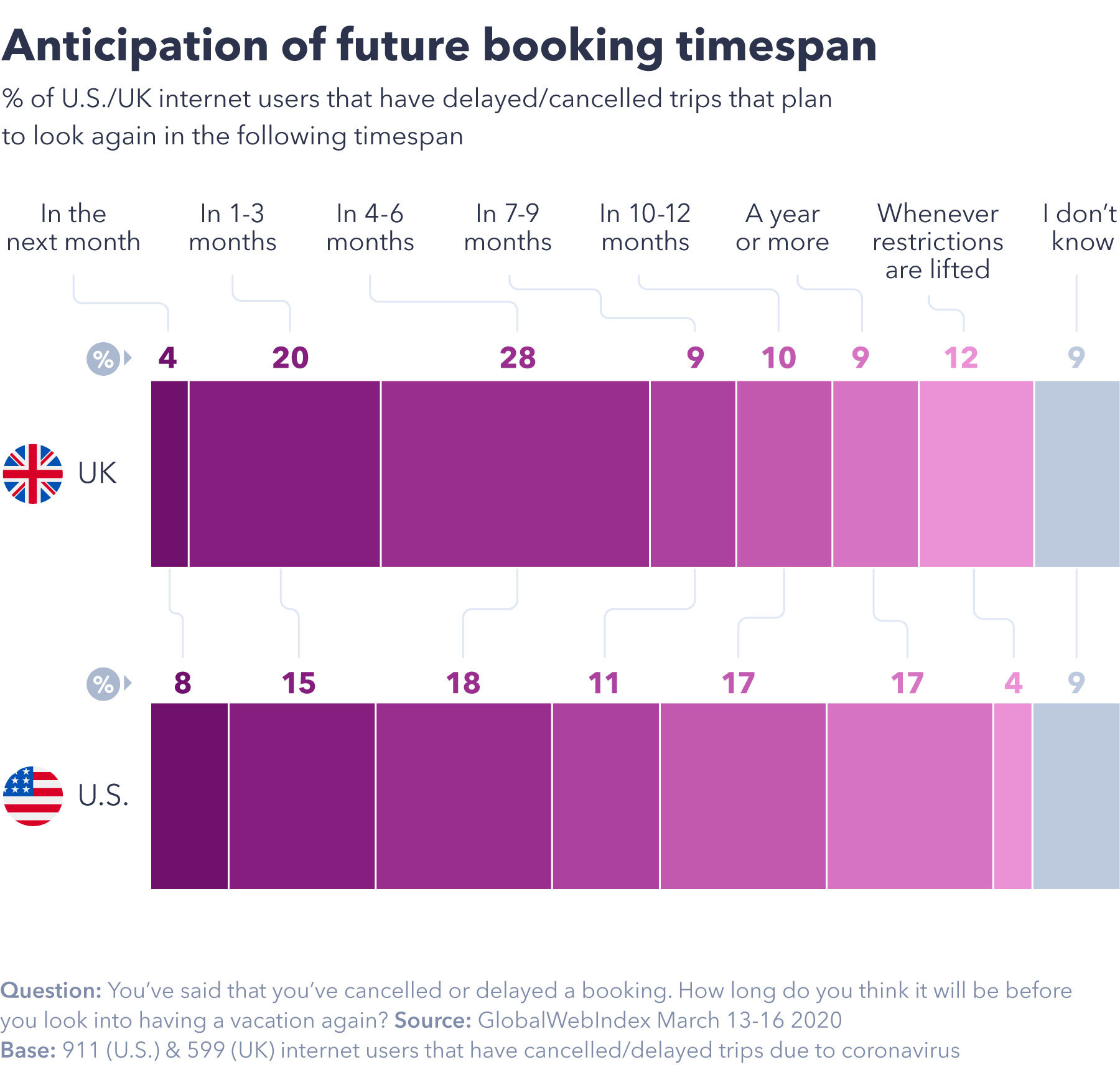

But, by asking consumers who’ve delayed or cancelled travel plans when they expect to plan trips again post-crisis, we can at least tease out their readiness to jump back into travel, or gauge whether their behavior has profoundly changed.

There’s a noticeable split between U.S. and UK markets here. U.S. travelers tend to be more conservative in predicting when they’ll be traveling again. UK consumers, however, appear keener to reinstate their travel plans as soon as they can; the majority anticipate returning to vacation planning in the next 6 months.

This data has to be read carefully; as governments are now dictating what travel is even possible, the timeline here isn’t as important as the intent behind it.

Looking through the lens of intent, UK consumers seem optimistic about planning future trips, whereas U.S. consumers appear more pessimistic about their future travel prospects, and will need particular nurturing back into travel planning.

Travel providers are expected to be on the front line for advice and guidance.

Even if consumers can’t travel, it doesn’t mean they can’t engage with travel brands during this time. Staying close to customers is extremely important for any company during this crisis.

Our most recent coronavirus research provides insight into engagement with travel brands, and who consumers see as the authorities for information.

While flight bookings have plummeted, data from travel price comparison service Icelolly has shown more volatility in searching behavior, with consumers at least eyeing up locations still relatively unaffected.

Consumers might not be booking trips, but that’s not to say they aren’t thinking about them.

One way of assessing where travel brands stand is seeing where consumers turn to for travel advice. The majority of consumers see travel as a public health issue, which is another sign of how deeply coronavirus has affected the market. They’re turning to the World Health Organization and government bodies for travel guidance in the first instance.

But travel brands play a role, with airlines commanding a decent audience of vacationers looking for travel advice in both the U.S. (18%, above trending posts on social media) and the UK (19%, above trending posts on social media and even medical websites).

Airlines and other travel companies need to be mindful of the role they’re playing for consumers at this point.

Consumers are deciding where to reallocate their vacation funds.

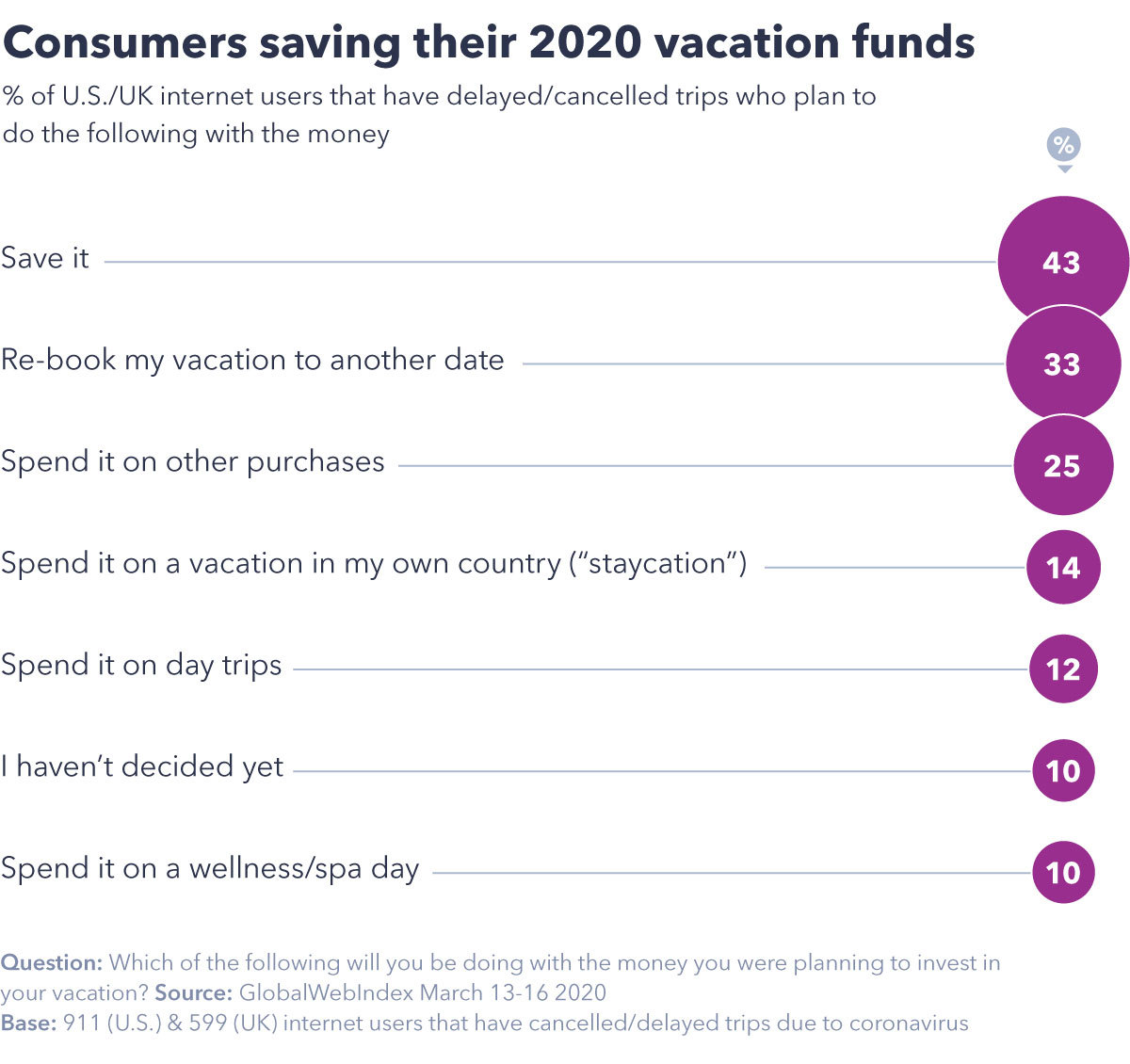

With so many consumers altering their travel plans, the obvious question is: where will their money go instead?

The picture here is virtually identical in both the U.S. and UK: just under half plan to save the money, while a third intend to re-book their vacation at another time.

By comparison, not many plan to invest in a “staycation” or day trips instead.

With so many potential travelers saving, brands wanting to entice these consumers back will have to keep them engaged, so they don’t become too withdrawn from planning to travel at all.

Our data also suggests that despite reports of hoteliers turning to staycation packages, at the moment, consumers are more willing to save than travel domestically.

Even as budgets are understandably hit, there needs to be more cut-through in the market to make consumers aware of enjoyments to be had in their home country – as long as this remains a safe and viable alternative.

There are clues to be found on how the travel industry can rebuild.

Looking at how press coverage about travel has developed shows just how quickly – and how far – the goalposts have shifted.

Just two weeks ago, newspapers were reporting on the bargain deals available in Italy and South-East Asia, before widespread restrictions were put in place. Due to greater imposed travel bans and heightened consumer awareness, that sort of approach quickly became inappropriate. You only have to look at the negative press coverage campaigns in the vein of “keep calm and carry on” have received.

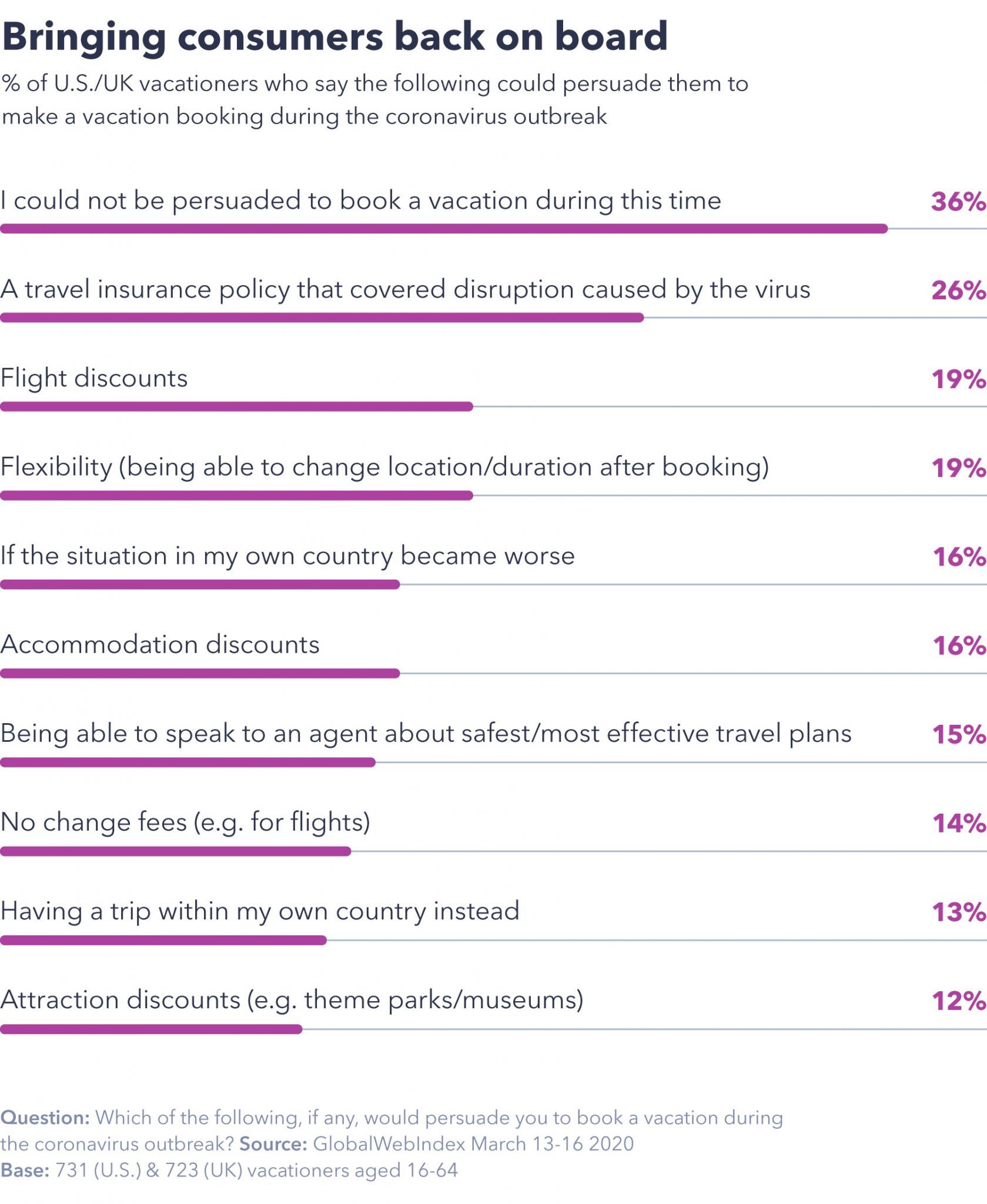

Our latest wave of research into coronavirus looked into what might persuade vacationers to travel during the outbreak. But as attitudes to international travel are changing so rapidly, this data is probably best understood with a long-term perspective.

So, not as a clue into how travelers can be targeted now, but to identify which consumers can help invigorate the market once the worst has passed.

A third of vacationers could not be persuaded to travel at all during the coronavirus outbreak. But a strong travel insurance policy (26%) and flight discounts (19%) would attract some travelers to book during this time.

So long as flights are operating, there are some consumers who could be persuaded to travel.

It’s likely the outbreak has generated more awareness and interest around travel insurance, and even in the long-run, insurance will likely be on the front-line of travel marketing.

Many airlines have already sought to provide more flexibility for new and existing bookings, something which is likely to resonate with around a fifth of vacationers in these markets.

These more opportunistic vacationers – who could be persuaded to travel under some circumstances – skew young and male, and have been frequent travellers up until this point.

We have to offer caution here though.

Consumers looking to travel in these present times tend to be less worried about coronavirus and are more likely to think governments are overreacting, which puts them out of step with most people in the marketplace.

Looking at how the situation (and its subsequent press coverage) has changed, targeting these consumers too openly during this time is likely to be branded irresponsible. It may be more productive to think of them as consumers who can help restart the market once the overall outlook is more optimistic.

In challenging times, staying informed is key

No-one knows exactly how the coronavirus outbreak will pan out.

Even a few weeks ago, the thought of the Western world extensively closing its borders was unlikely to have crossed anyone’s mind.

We can’t disguise that the implications for the travel industry – between government bans and waning consumer appetite – are fairly bleak.

But there are signs that consumers in the UK are still thinking about vacations, even if they can’t or choose not to book them right now.

U.S. vacationers appear to have been hit harder, and will likely need more nurturing to come back on board later on.

Some vacationers are deferring or rebooking vacations, but many plan to save the money instead. If these funds are to be accessed, more could be done in promoting domestic trips – as long as they remain a safe option.

It seems many travelers would rather not spend the money at all than travel domestically, and won’t think of staycations or day trips without some extra nudging.

This year, the summer vacation as a concept may simply not exist. But eventually, some kind of normality will be restored. Although it’s not yet known when, the insights here can hopefully shape strategies in rebuilding the travel industry after one of its most cataclysmic events.

If your business is being impacted by the COVID-19 pandemic and you’re looking for help, our friends at Fuel have compiled thismaster list of crisis management resources for hotels.