Without impulse buys, attractive displays and full-scale, in-store incentives, commerce in the coronavirus age has gone digital.

With in-store shopping stalled and then restricted, social media has been the means into consumers’ homes since March. How can brands close sales with that boost in access and reliance on e-Commerce?

This is part of the insight GlobalWebIndex sought to gain during its recent study of consumers’ tendencies in social media and their implications for business. GWI is a market research SaaS company. They provide audience insight to marketers, media agencies, and publishers.

Live streaming, shifts in user purpose in social media, and emerging platforms such as TikTok and Twitch shape the consumer path toward heavy post-pandemic reliance on e-Commerce.

Internet users turned to social media for current events and news. That has taken a leap during the pandemic, according to social media statistics.

After an uptick in social media use for entertainment, recent events have turned the tide back to more social elements on many platforms. Younger consumers are using more apps, messaging services, and social media.

Cary Murphy, Charlotte Regional President and Content Director at The Brandon Agency, says it remains to be seen if the heightened engagement on social channels and increase of direct-to-customer online sales will continue – but the signs are there.

He cites communities such as the FIREDISC owner group on Facebook. Current and prospective FIREDISC cooker owners congregate in this forum, asking advice, sharing images and recipes, and tagging friends to introduce them to a product they love.

They’re a loyal tribe, quick to share successes and stem the rare critical post.

“All signs seem to indicate a permanent shift has taken place,” Murphy said. “We are seeing incredible engagement in Facebook (owner) groups, as people are eager to share experiences and relate to fellow humans with common interests … As a brand, it’s a good time to be laying the framework of social media marketing strategy, as establishing strong connections.”

It’s also a matter of trust

Findings in the study:

- Of consumers who’ve watched more videos during the pandemic, 23% say they’ll keep it up when the masks come off.

- Older generations in Western populations keep a social media presence to stay in touch with friends. For all generations, there’s increased dependence on social media news feeds – and 60% of Gen Z consumers lead the way.

- Although 47% of consumers get news on social media, 33% don’t consider it reliable. Slightly more trust health organizations (34%), but only 29% refer to them. Social’s advantage over static sites: Greater ability to interact.

Through social listening – monitoring your brand’s channels for customer feedback and direct mentions – companies can impact conversation. The government and public hold brands accountable for shared and posted information. President Trump signed an executive order to dismantle legal protection for social media platforms for user-created content. Facebook and Twitter responded with guidelines for sharing news stories and a plea to read posts before sharing. Implementing these measures could increase trust in these platforms.

Remember when social media was mostly social? As recently as 2019, statistics showed platforms acted primarily as entertainment hubs. Since 2017, users who kept up with friends on social media dropped from 42% to 33%. Instead, they’re consuming content during their time on social media.

That is until coronavirus hit.

Extra time on our hands led to more devices in our hands, returning to entertainment and connection. Internet users in the U.S. and U.K. reveal a 55% increase in those who have shared more on social media in the past two months. They’re more likely to open up about their struggles (30%) than before.

Consumers not only want news and interaction, but also to reconnect with contacts and establish new connections as the world, perhaps for the first time, grapples with such similar plights everywhere.

For Gen Z, social media has lessened the loneliness of isolation (65%), 61% among Millennials. Some students and those just joining the workforce can’t maintain or build relationships in person. Social media and video conferencing have become the lifeline, factors to consider as brands develop their social media marketing strategy. Brands need to be active, diversified across all platforms to increase and maintain brand presence if they want more followers and engagement, says Lindsey Waltz, a Project Manager at The Brandon Agency.

“With attention spans narrowing, it’s important to keep your brand concise, creative, and consistent to build brand awareness and become recognizable quickly,” Waltz said. “There are no days off in the social media world, and the competition is ever increasing. Therefore, strategizing, planning and learning from your previous performance is key to growth.”

Insights:

- The pandemic has shifted users away from worry about self-image in their social media presence, with 42% saying there’s less pressure to represent themselves unrealistically.

- More men (46%) than women (31%) say they’re more open about personal struggles on social platforms.

- Escapism and humor still rank highly for most-shared kinds of posts.

Inspiration comes from friends and family (74% chose this as the top priority of social media), and local communities (52%). Online groups bring self-isolating users together and to share advice and knowledge. Will this persist when the pandemic ends?

As consumers become more concerned about wellbeing for themselves and others, their worry over digital wellbeing has dropped. People don’t monitor screen time as they did a year ago, especially among those who stay online most. 14% of internet users in the U.S. and U.K. expressed concern about a spike in online time. Of those, 34% were more focused on their mental health. The web is perceived as less of an intrusion into everyday life, and more an avenue to everyday life.

Most users don’t intend to do this forever; but among heavy users, 25% say they’ll keep up the screen time after coronavirus subsides. It remains to be seen whether this is a current sentiment or an intent that they’ll act upon.

Social media engagement

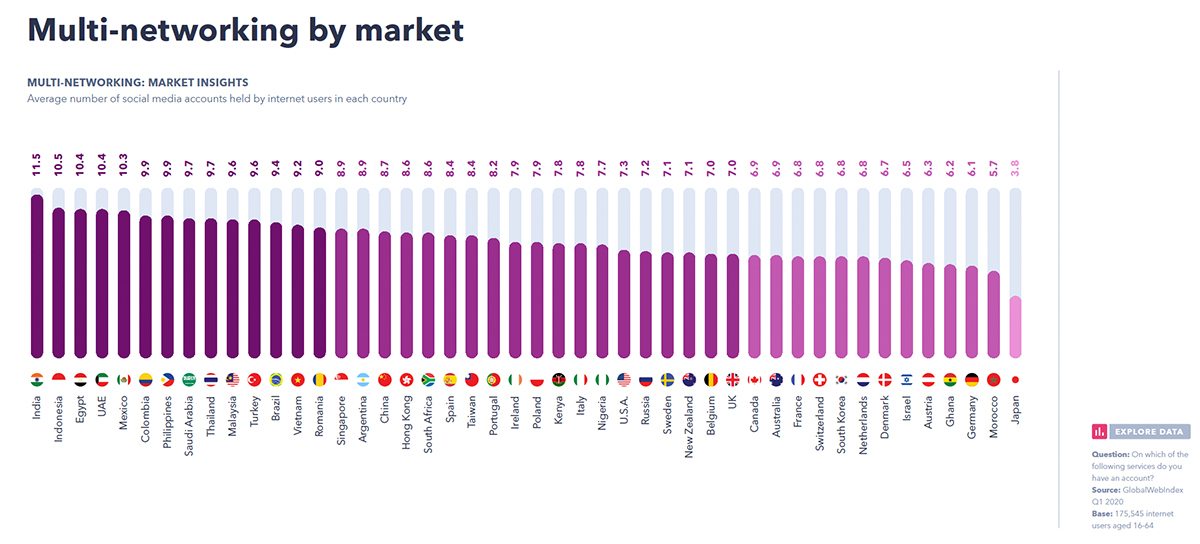

Social media time had plateaued in the past year. Kenya, Nigeria, South Africa, and the United Arab Emirates have the biggest increase among 18 markets. Unsurprisingly, the heaviest users lead the way in increased screen time. Younger groups, especially in places of fast-growth markets, are ardent users of messaging apps and social media. Gen Z and Millennials are at the forefront, especially in the Middle East and Latin America.

Their parents are also getting in on it. Baby Boomers are implementing social media into their daily habits. Brands should realize that an older audience is also within reach. Those trends are more compelling than the expected trajectory among younger consumers, especially in business. Gen Z has lost a bit of its exuberance as recently as mid-March, when the pandemic took hold. More than other generations, they’ve regressed to old patterns.

It’s been a topsy-turvy ride for social media platforms. Some of The Brandon Agency’s clients – such as Fish Hippie, Heybo, Williams Knife Co., and United Sewing Automation – had to grapple with obstacles, while capitalizing on opportunities, said Haywood Brandon, an Account Manager with the agency.

“First, paid media became impossible for our face mask client (United Sewing Automation), as social media platforms banned the advertising of medical materials,” Brandon said. “This caused serious trouble for revenue and really showed the power Facebook has in generating revenue.”

Lifestyle apparel clients such as Fish Hippie and Heybo faced a different challenge: Sensitivity in a touchy time. The Brandon Agency paid attention to images used, steering clear of large gatherings and parties, unless it referred to looking forward to getting together again someday.

“With the initial shutdown, it seemed that traffic on mobile devices increased significantly, as folks had more time on their hands,” Brandon said. “We saw this as an opportunity to connect with potential customers, so we began running paid social ads surrounding our sales items to generate more and more conversions.”

Even with economic uncertainty, the strategy yielded results. With the consumers’ attention, Heybo offered deep discounts (75%), as did Fish Hippie (50%). Fish Hippie earned nearly $30,000 in a single day.

“We used social media’s newfound popularity to market our sales and it was a home run,” Brandon said. A bold yet sensitive approach – with big sales – resonated with customers.

“The pandemic caused me and my clients to write a few social media posts with caution and do our best to follow the rules, but to also capitalize on the opportunity to provide a fair deal to those who were willing to buy discounted items,” Brandon said. “Users really enjoyed the heightened interaction between brands and consumers and it seemed to allow us to create many new customers along the way.”

Some segments – such as Baby Boomers – are expanding to multiple networks. They rely on standard apps and sites but have branched out. Brands can discern the tone of their conversations through social listening.

It’s critical in commerce to decipher the needs and wants of this audience. Social media has expanded from sites and apps to multiplayer video games and videoconferencing. Even real-time collaboration on Google Docs has brought people together.

The social media landscape

Facebook, and then YouTube, have the greatest membership in social media worldwide.

Facebook owns the next 3 platforms: Messenger, WhatsApp, and Instagram. WhatsApp has grown but Instagram has surpassed it. How each responds to misinformation in a year in which information is paramount shapes public opinion.

Most have been anticipatory. Facebook responded with new privacy controls. Twitter established COVID-19 hubs. Consumers look to large brands as the pulse of a fight against coronavirus and supporters of increased awareness. Of Facebook users asked in April, 24% in 17 countries said they knew of that platform’s support of the community during the crisis – 13% said the same on Twitter.

Businesses reported donations of masks, supporting small businesses, and evolving shifts in their operating models, on social media. Users (77%) saw brand ads that demonstrate their COVID-19 response favorably, especially what brands are doing for customers. They’re likely to stick with those brands after the crisis.

Consumers visit YouTube most frequently; Instagram and WhatsApp leapfrogged Facebook Messenger in this trend. Outside of China, internet users who visit Instagram monthly are up 8% since 2019. Since then, 74% of female Millennials have logged in to the ‘gram. That’s of concern to Facebook and YouTube, who are missing out on a pivotal demographic.

And then there’s the dancing-clip, youth-oriented phenomenon of TikTok.

In Q1, 20% of internet users outside of China were on it, skewing to a Gen Z crowd, mostly female. Since then, TikTok and platforms similar have begun to appeal to a broader audience.

Gen Z users post the most videos; but that space has become a favorite for parents with young kids, too. TikTok, with a unique algorithm that creates a happy social media space for all users – as opposed to sometimes conflict-ridden discourse on Facebook and Twitter – offers streams of family-friendly content and overall fun experience.

Usage spikes for TikTok emerged in March, but it was uncertain whether it was situational or long-term. Numbers dipped during the outbreak, but have rebounded. The big takeaway: short-term videos can become a draw to an increasingly diverse audience.

An analysis of platforms by usage frequency is nuanced. Gen Z users don’t use messaging tools as often as they do Instagram and YouTube. Facebook remains in its portfolio, but not to the extent of Gen X and Baby Boomers.

Newcomers who saw a lockdown surge, such as TikTok and Twitch, bear a unique opportunity to expose brands to consumers in a time of crisis – a big consideration, should this not be the final pandemic of our lifetimes. TikTok and Twitch users respond positively to coronavirus updates in marketing and haven’t had to rebuild trust for that as Facebook has.

Facebook still leads in messaging services, with Messenger and WhatsApp, both growing platforms. Apple is getting in on it, too. Their next update of iMessage is to include pins, inline replies, and mentions, mimicking rival apps. An app with increasing popularity you might not have heard of, Telegram, with a 12% user growth in the past quarter, is a leader in global apps tracked in the GWI study.

Consumers spending more time online for social purposes presents an opportunity to share brand-related information. And 20% of those who say they’ve shared more lately on private channels recommend brands and products more often. These platforms are critical to increasing brand reach. After the outbreak, 24% of WhatsApp users say they’ll not cut time spent on messaging services. Overall, 44% of consumers in 20 countries have increased time on messaging apps since the outbreak.

Now’s the chance for brands to flex on these channels.

Social media behaviors

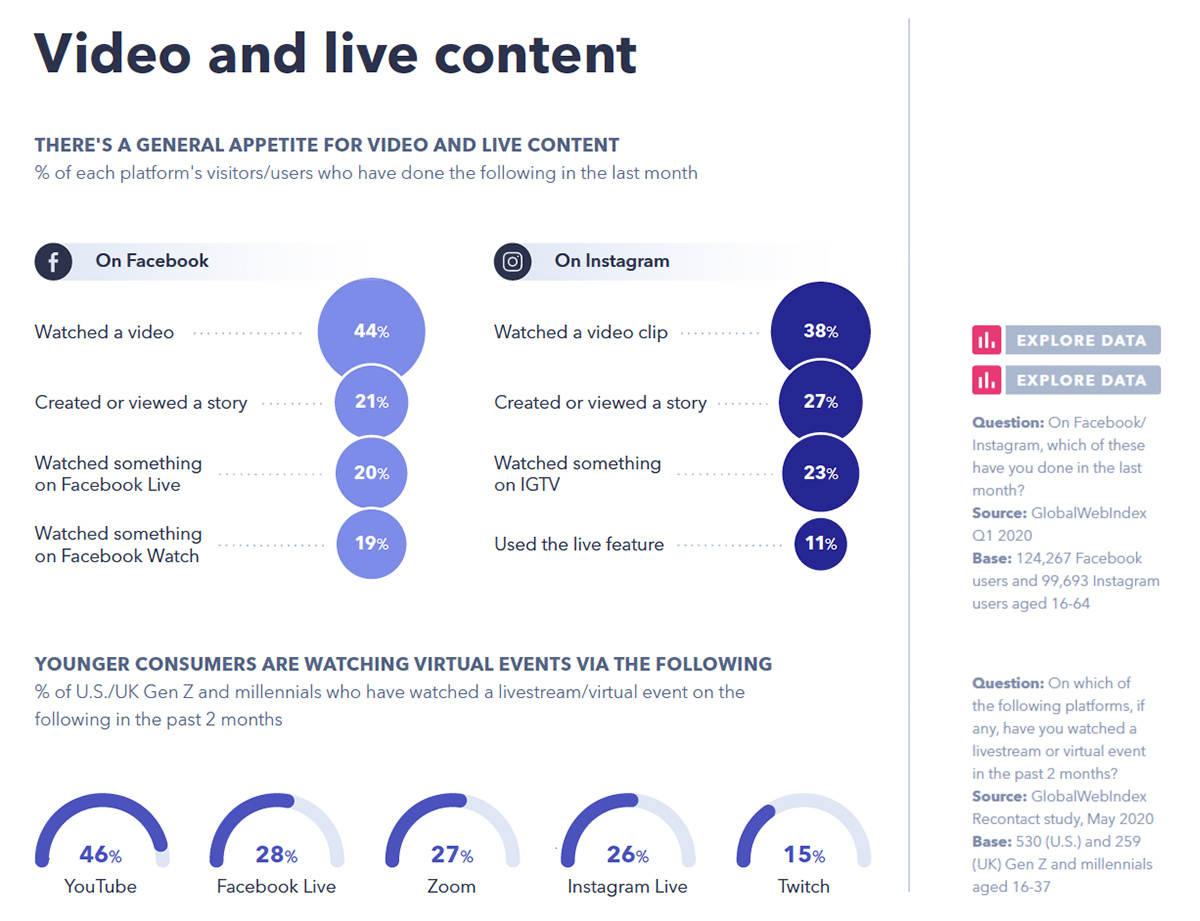

A hunger for live content and video pervaded media habits pre-pandemic. Platforms enticed consumers with standard clips and new formats, such as Facebook Watch and IGTV.

Younger users are happy to attend virtual events. But will they and other generations keep streaming as society opens up? We know 23% of global consumers intend to watch more videos after COVID-19. Suddenly relevant players such as Zoom could also give the competition a run for the money. Live-streaming appears here to stay.

Brands have improved tech offerings. Facebook revved up its updates for a live producer streaming platform for creators. Shopping features Instagram Live and incorporated ads in AGTV videos have emerged. Brands must provide the tools consumers need for maximum interaction, lest they become irrelevant in the post-pandemic age.

Solidarity building on social media

Q2 data reveals that some behaviors in the COVID-19 lockdown can become permanent.

The past 2 months, users in the U.S. and U.K. say they’re most connected to others on Facebook, Facebook Messenger, and YouTube. In times of timely communication, such as environmental threats and civil rights protests, these spaces foster solidarity.

Each platform has its distinctive tone:

- Facebook. Serious content, news and personal updates

- TikTok. Personal updates, but with funny memes and entertaining video

- Instagram. A melding of the two; news shares, memes, videos, life snapshots

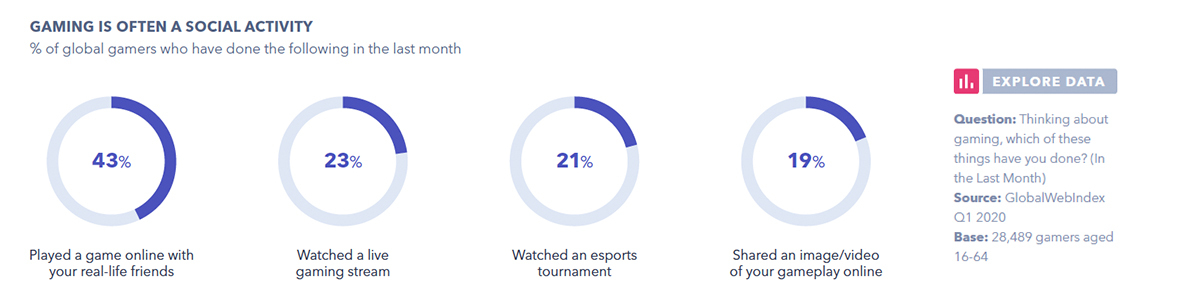

Gaming has emerged as a social media stream. On Facebook alone, more than 700 million people interact with gaming-related content monthly, indicating that social gaming fosters connections, too. Worldwide, 43% of gamers play with real-life friends monthly. In China and the Philippines, that rises to 55%.

Video game brands can anticipate valued social interactions to continue as gamers emphasize the connected experience. Of online gamers, 53% have played more because of coronavirus. Of those, 20% say they’ll keep it up.

The social purchasing journey

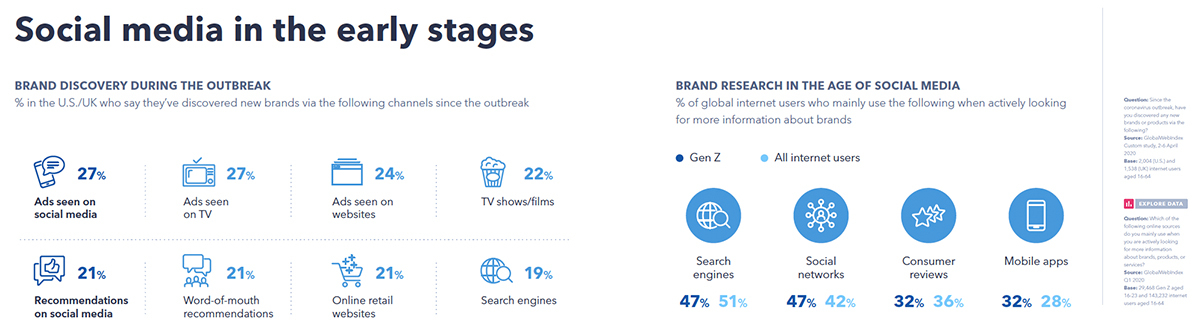

Search engines have dominated GWI’s brand discovery data.

Although social media plays a huge role early in the purchase journey, it’s yet to catch peer-to-peer recommendations or TV advertising – even as younger generations in fast-growth markets alter the landscape, especially since COVID-19’s onset.

Social media ads pushed to the fore of brand discovery because consumers increased their screen time during lockdown. They even surpassed traditional organic search and TV ads.

U.S. and U.K. markets followed this trend, despite an older demographic formerly slow to adapt to new habits. Direct response advertising has made an impact, and among Gen Z, social media has become the go-to for brand research after discovery.

Brands have responded to recent inflections in social issues, recognizing that 47% of consumers want to see support of the Black Lives Matter Movement as part of their message. It creates a sensitive marketplace in which recent social media advertising boycotts can have a bigger influence than before.

Digital natives in western society push that reality closer in a space with glacier-like movement, now that they’re becoming consumers. More than just an added buy button, social commerce has emerged with them – 20% of Facebook visitors of all demographics and generations use its marketplace monthly, for everything from furniture to clothing to gaming equipment.

Platforms such as Instagram encourage users to consider it a marketplace – adding a shop tab at the expense of the activity tab. Facebook also fosters this shift with Facebook Shops. Small businesses can reach consumers worldwide with an online shop only. Success here could alter the business model.

The pandemic has pushed many businesses of all sizes to the brink of crashing if they stick only to traditional methods of commerce. Those that can flourish are the ones who embrace new social solutions, at least on a trial basis.

Their business health hangs in the balance – and it’s not as easy as setting it and forgetting it, Waltz said. Agility in delivery is also key, such as geo-targeting – meaning, delivering specific content to a consumer based on their current location.

“You need to strategize the creative to match the audience,” Waltz said. “And for one brand that should be many, by geo targeting. And once you have a plan ready and designed — you need to make sure you are on and speed for all platforms, then engage as soon as it’s posted. Then performance — adjusting as needed, sometimes starting over. It’s so much more than a pretty photo and posting when it’s ready.”

Despite momentum, only 13% of consumers say a buy button would provoke them to purchase, even on the most popular networks in the most youth-oriented areas. Brands must do more.

Snapchat and TikTok become increasingly more difficult to ignore. Influencer culture leading a younger generation ensures their relevance.

These platforms recognize this. Snapchat enhanced its augmented reality offerings, and Gucci, an Italian luxury brand of fashion and leather goods, was first to implement a virtual try-on experience for glasses. Big brands have migrated to TikTok, banking on the network’s promise.

Placing ads for these audiences to see isn’t enough. It’s finding the audience that will fit their product, and understanding their behaviors and purchase desires, too.

About 20% of American and British Gen Zers have shared more influencer content on social networks and messaging apps since coronavirus happened. Brands feel closer than ever to consumers on these platforms, so a genuine message is a must.

Influencers have a feel for the pulse in local markets, an asset to brands trying to reach consumers in a time of heightened awareness of their values.

Impactful implications

- Social media will remain relevant. Internet usage has soared; when life evens out, consumption should level off. Social media’s influence will show not only in e-Commerce, but also in a bolstered sense of trust for accuracy – given a shift toward fending off disinformation and holding posters accountable for their content, created or shared.

- Brand engagement can benefit from consumers’ wishes to ramp up social interaction. Engagement with private channels is on the rise. Proactive accessibility for brands in these channels is essential.

- Live content, video, and virtual events will take center stage. As consumers remain reluctant to pack public venues, live streaming provides virtual gathering. Social platforms and tech firms should prioritize development and expansion of tools to support this trend if they want it to become mainstream.

- TikTok and Twitch make up for lower visitation figures with higher impact interaction. Advertisers and users flock to these places. They’re hotbeds for creators and influencers, and require big brands to furnish content that resonates with niche groups and a younger demographic.

- Social media is woven into the fabric of the purchase journey. With a stronghold on discovery and research, social media continues to increase its importance to brands and consumers. A cognizance of influencer, message, and platform can help a brand establish itself as a viable option for sales on those channels.

The Brandon Agency is ready to help your business navigate through the pandemic, through social listening, metrics, and proven strategies. Talk to us today about what we could accomplish with you.

Sources: GlobalWebIndex